+ 91 8380034900 | Helpline + 91 7353929800

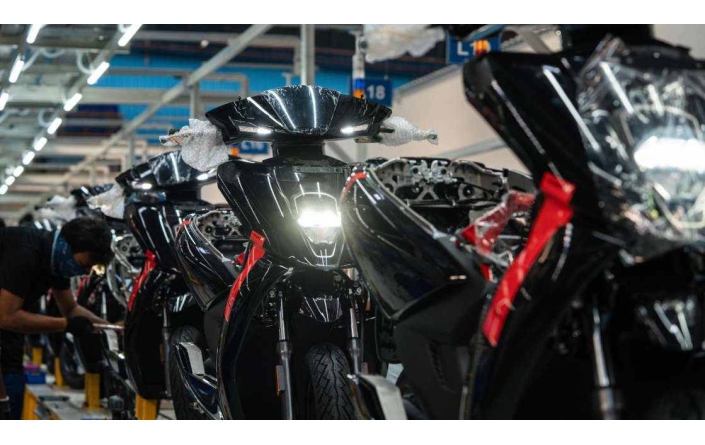

The pandemic has changed the buying behaviour of people. The surge in demand for e-commerce and home delivery has enabled the logistics industry to bounce back, and last-mile delivery companies have introduced advancements in their business model to come up with innovative solutions. One such advancement is the transition from ICE vehicles to cleaner EVs, owing to the surge in fuel costs, air pollution and digital intervention.

Last-mile delivery accounts for almost 53% of the total delivery cost—it is the most time-consuming, complex and expensive part of the shipping process. But the increase in adoption of EVs has resulted in operational savings for delivery firms and also aided delivery partners to cut down on fuel costs.

Why EV financing?

While lenders and NBFCs cite the issue of the residual value of EVs and are hesitant to grant loans to vehicle and battery manufacturers as well as to fleet aggregators, almost 85% of EVs sold are financed. This makes it evident that the support for EV financing outweighs the resistance as 85% support it and only 15% resist it.

Logistics is an expensive affair—transitioning from ICE to EV results in additional cost for the riding fleet and aggregators. Shared mobility can help overcome this challenge. E-commerce giants Amazon and Flipkart have tied up with Mahindra Electric, Hero Electric and EVage, and solved many pain points including capital expenditure for training the riding fleet, charging infrastructure and enabling riders to get their own vehicle for delivery.

Further, delivery partners or riders who are hired by logistics companies are usually unskilled or semiskilled labourers without a strong credit history or income level. Therefore, banks and NBFCs hesitate to provide two-wheeler financing to them. To overcome this challenge, EV financing platform Revfin, a start-up, has raised Rs 100 crore in debt to foray into electric two-wheeler funding and make financing accessible to delivery partners.

Summing up

India was the fastest-growing first-mile and last-mile delivery market even before the pandemic. The lockdown led to the logistics industry getting even stronger. The logistics industry has taken a lion’s share in EV evolution, thus it becomes extremely important to extend easy finance to this industry.

Credits - msn

Web Design Company - Graphinet